2022 Q4 Market Report

Cedi Performance and Macro-Economic Indicators

A fourth-quarter appreciation of the cedi against the US dollar, the British pound, and the Euro of 11.89%, 3.78%, and 2.73% respectively, reduced the 2022 depreciation rates of the cedi against these major currencies to 30%, 21.2%, and 25.4% respectively. The decrease in the rate of depreciation of the Ghana cedi relative to the major currencies during the last quarter of 2022 can be attributed to the government’s staff-level agreement with the IMF which boosted investor confidence as well as a reduction in the demand for foreign exchange. The reduced demand for foreign exchange can be attributed to the government’s announcement of the gold for oil swap, which will reduce forex demand by bulk oil distributors, as well as the Bank of Ghana’s withdrawal of forex support for the import of rice, poultry, vegetable oils, toothpicks, pasta, fruit juice, bottled water, ceramic tiles, and other non-critical goods.

The headline inflation rate accelerated to 54.10% at the end of 2022 compared to 12.60% at the end of 2021. Food and non-food inflation for the end of December 2022 were 59.7% and 49.9% respectively, as compared to that of December 2021 which were 12.80% and 12.50% respectively. The hike in the inflation rate at the end of the year can be attributed to rising utility tariffs, fuel prices, cost of housing, transport, and food and beverages.

The Bank of Ghana raised the monetary policy rate from 14.50% at the end of 2021 to 27.00% in November 2022 citing the need to control inflation as the risk of upticks in the inflation rate remains.

The table below provides details of the policy rate, inflation rate, and movements in the currency market.

Economic Review

| Year 2022 | Year 2021 | Change (YoY) | |

| Monetary Policy Rate | 27.00% | 14.50% | 12.50% |

| Inflation Rate | 54.10% | 12.60% | 41.50% |

| 31st December 2022 | 31st December 2021 | Year-to-date Depreciation | |

| US Dollar/Ghana Cedi | 8.58 | 6.01 | 30.00% |

| British Pound/Ghana Cedi | 10.31 | 8.13 | 21.17% |

| Euro/Ghana Cedi | 9.15 | 6.83 | 25.38% |

Government Borrowing

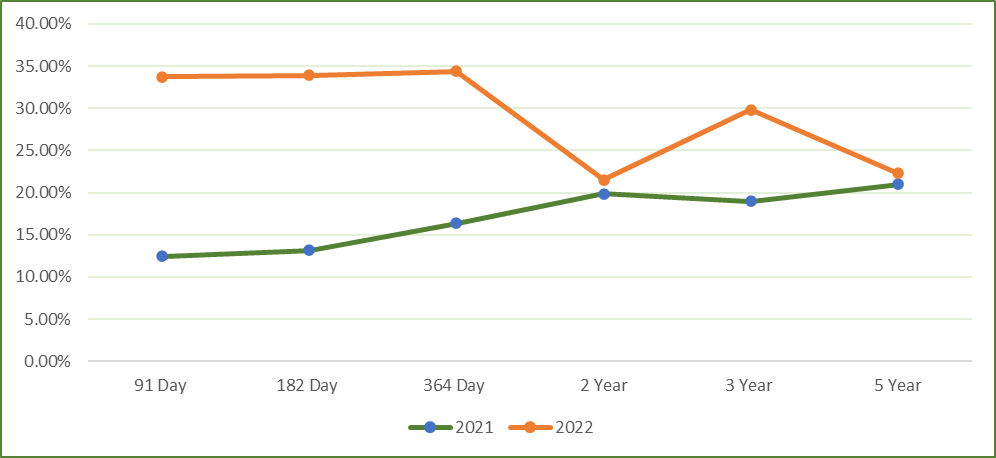

Interest rates on the 91-, 182- and 364-Day Treasury Bills began the year at 12.92%, 13.40%, and 16.88% respectively, and ended the year at 35.36%, 35.90%, and 36.10% respectively. The government also issued two 2-year notes at an average interest rate of 20.63%, three 3-year bonds at an average interest rate of 23.73%, two 5-year bonds at an average interest rate of 21.53%, and a 6-year bond at an interest rate of 21.75% during the year. Compared to 2021, interest rates of all GoG securities trended upward.

| 2021 | 2022 | Difference | |

| 91 Day T-Bill | 12.48% | 33.71% | 21.23% |

| 182 Day T-Bill | 13.17% | 33.92% | 20.75% |

| 364 Day T-Bill | 16.34% | 34.38% | 18.04% |

| 2 Year T-Note | 19.88% | 21.50% | 1.62% |

| 3 Year T-Bond | 19.00% | 29.85% | 10.85% |

| 5 Year T-Bond | 21.00% | 22.30% | 1.30% |

The yield curve at the end of 2022 was inverted, that is, lower interest rates on long-maturity bonds. This indicates that it will be difficult to issue long-term bonds without a significant maturity premium.

Stock Market Performance

The stock market could not maintain its positive returns from 2021 as the GSE Composite Index (GSE-CI) and GSE Financial Stock Index (GSE-FSI) closed 2022 with annual returns of -12.38% and -4.61%, respectively compared to 43.66% and 20.70% at the end of 2021. However, the GSE-FSI performed better than the GSE-CI due to major price recoveries of the following finance stocks – SIC, TBL, ACCESS, EGL, and ETI.

During the quarter, there were 7 gainers. SIC was the top gainer with a year-to-date (YTD) gain of 287.5%, closing the year at GH₵0.31. TBL, ACCESS, BOPP, EGL, GGBL, and ETI also recorded growth in their share price with YTD gains of 135.29%, 27.30%, 15.04%, 14.70%, 13.89%, and 7.14% respectively. On the other hand, UNIL led the pack of 14 losers, ending the quarter at GH₵3.88, representing a YTD loss of 34.13% followed by PBC ending the year at GH₵0.02, representing a 33.33% YTD loss. MAC lost the least during the year with its price dropping by 0.19%, ending the year at GH₵5.38. Prices of 9 stocks remained flat.

Some developments that occurred during the year on the stock exchange were Golden Star Resource Ltd delisting from the Ghana Stock Exchange (GSE) in January 2022 and the listing of Asante Gold Corporation on 29th June 2022.

The performance of the gainers and losers during the year 2022 on the GSE is detailed in the tables below.

Gainers

| Share Code | Year High (GH₵) | Year Low (GH₵) | 31st Dec 2021 (GH₵) | 30th Dec 2022 (GH₵) | YTD Gain |

| SIC | 0.33 | 0.08 | 0.08 | 0.31 | 287.50% |

| TBL | 0.80 | 0.34 | 0.34 | 0.80 | 135.29% |

| ACCESS | 4.01 | 1.90 | 3.15 | 4.01 | 27.30% |

| BOPP | 7.65 | 6.00 | 6.65 | 7.65 | 15.04% |

| EGL | 3.30 | 2.79 | 2.79 | 3.20 | 14.70% |

| GGBL | 2.22 | 1.80 | 1.80 | 2.05 | 13.89% |

| ETI | 0.20 | 0.13 | 0.14 | 0.15 | 7.14% |

Losers

| Share Code | Year High (GH₵) | Year Low (GH₵) | 31st Dec 2021 (GH₵) | 30th Dec 2022 (GH₵) | YTD Loss |

| UNIL | 5.89 | 3.88 | 5.89 | 3.88 | 34.13% |

| PBC | 0.03 | 0.02 | 0.03 | 0.02 | 33.33% |

| CAL | 0.91 | 0.65 | 0.87 | 0.65 | 25.29% |

| FML | 4.00 | 3.00 | 4.00 | 3.00 | 25.00% |

| GCB | 5.24 | 3.70 | 5.24 | 3.94 | 24.81% |

| MTNGH | 1.11 | 0.75 | 1.11 | 0.88 | 20.72% |

| TOTAL | 5.02 | 4.00 | 5.02 | 4.00 | 20.32% |

| SOGEGH | 1.20 | 0.96 | 1.20 | 1.00 | 16.67% |

| EGH | 7.60 | 6.50 | 7.60 | 6.64 | 12.63% |

| RBGH | 0.60 | 0.54 | 0.60 | 0.54 | 10.00% |

| CMLT | 0.11 | 0.10 | 0.11 | 0.10 | 9.09% |

| GOIL | 1.82 | 1.72 | 1.82 | 1.72 | 5.49% |

| SCB | 20.30 | 20.16 | 20.30 | 20.16 | 0.69% |

| MAC | 5.39 | 5.38 | 5.39 | 5.38 | 0.19% |

Current Economic Environment and Investment Implications

Real GDP growth rate for third quarter 2022 was 4.8% compared to 3.5% in the same period in 2021. However, current economic hardships such as the rising inflation rate and the depreciation of the cedi are likely to slow down GDP growth in subsequent periods. It is not surprising that the government’s targeted GDP growth rate is 2.8% for 2023.

The government is seeking an IMF bailout due to its inability to service its debt obligations. Currently, a staff-level agreement with the IMF has been reached but for an IMF Agreement to materialise, the government must implement a debt sustainability program. Unfortunately, the government’s proposed Domestic Debt Exchange (DDE) programme has been met with stiff opposition from labour unions, fund managers, individual bondholders, and other interested parties. This is expected as the programme will cause liquidity constraints and a significant reduction in return on investment.

We expect further tightening of the Monetary Policy rate and interest rates to inch upward due to the inflationary pressures.

On the capital market, the returns of the GSE Composite and GSE Financial Stock Index are likely to decline further due to the:

- Government’s pending domestic debt exchange programme – This will have a negative impact on interest income and profits of the listed banks, as their assets are mostly Government of Ghana securities.

Depreciation of the cedi – This will have a negative impact on manufacturing companies as the cost of importation of their raw materials will increase leading to low production and an increase in the prices of finished products.

Licensed as an Investment Advisor and Pensions Manager by the Securities and Exchange Commission and National Pensions Regulatory Authority.

Contact Us

The Octagon,

11th Independence Avenue,

2nd Floor, Suite A 205,

P.O. Box CT 2069

Accra, Ghana

Tel: +233-(0)30-707 92 56

Tel: +233-(0)30-701 02 49

Email: capital@semcapitaladvisors.com

Copyright © 2022 SEM Capital Advisors | Powered by Gesatech Solutions